When the 16th Amendment was passed which created the US Income tax it was a measly 1 percent tax on rich people. Congress actually debated capping it at 10 percent because they thought a 10 percent tax was outrageously high. Of course now even if you are a poor slob that makes minimum wage the government is going to with hold 10 percent of your pay check in income tax, FICA tax and other taxes. Financially conservative Republican Herman Cain thinks you own the government 9 percent of you income in the form of a 9 percent income tax. Of course Herman Cain wants to take another 9 percent of the money you spend on purchases with a national 9 percent sales tax. And he wants to double tax you on your income with another 9 percent tax on any corporate profits you earn from stock you own in corporations. For those skeptics check out this URL

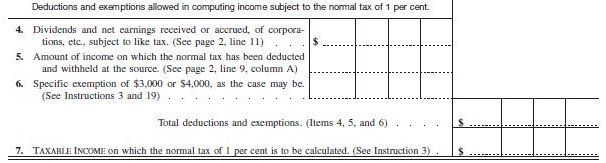

www.irs.gov/pub/irs-utl/1913.pdfwhich contains a the first US income tax form along with that 1 percent tax rate. Only rich people who made more then $3,000 (which was about $40,000 io $50,000 in 2011 dollars) had to pay income tax. Of course in those days (1914) most Americans lived and worked farms and didn't make enough money to be required to pay the tax.

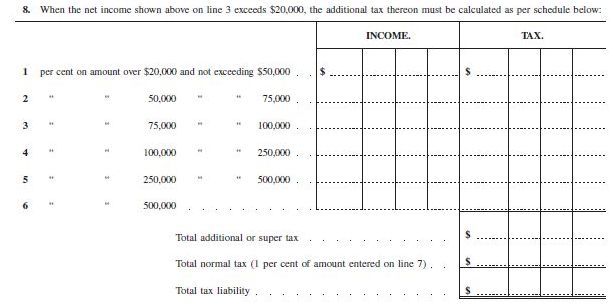

In 1914 the income tax maxed out at 6 percent for people that made more then $500,000.

Following this article about Conservative Tax and Spend Repulican Herman Cains 9-9-9 tax I included some more info on American's first income tax.

Cain's '9-9-9' is campaign centerpiece

His shorthand for tax plan gains cachet

by Sandhya Somashekhar - Oct. 9, 2011 12:00 AM

Washington Post

If you know one thing about Herman Cain, it's probably that he used to be the chief executive of Godfather's Pizza.

If you know two things about him, you are likely to have heard of something called "9-9-9."

That is the Republican businessman's shorthand for his tax-reform plan. The idea has become the centerpiece of his campaign for president, boosted recently with surprisingly strong showings in opinion polls and a closely watched GOP straw poll in Florida.

Cain uses 9-9-9 like a mantra, promoting the plan in his Southern drawl. It has become so familiar that people sometimes ask him about it on the street.

Said one man: "It's refreshing to hear a plan that has some logic."

Under 9-9-9, Cain proposes replacing the current tax system with a 9 percent corporate tax, a 9 percent personal income tax and a 9 percent national sales tax. He argues that the simple plan would revive the economy by promoting growth and, in his characteristic blunt style, asserts that it would free taxpayers from a complicated tax code that has become "the 21st century version of slavery."

Tax reform hasn't played a central role in the 2012 GOP presidential race, with the candidates instead bickering over Social Security and who has a stronger record on the economy. But whether to raise taxes, or reform the tax code, is a big part of the debate over cutting the federal budget deficit.

Cain has said that his plan would collect about the same amount of revenue that now flows into the government, and that it would increase as the economy strengthened. Experts, however, say that is difficult to know because the candidate has given only broad outlines for his proposal, which would allow some credits and deductions.

Conservative economists say Cain's plan is a good one - in theory. They say it would prevent the government from hindering growth by choosing who receives tax breaks. But they are skeptical that it would get much traction in Congress, and they warn that adopting a national sales tax could open a Pandora's box. Currently, only states and the District of Columbia can charge sales tax.

Liberal economists say the plan would shift more of the burden to lower- and middle-income families, the beneficiaries of many of the regulations and deductions that complicate the tax code.

"Mr. Cain's tax proposal only makes sense if you believe that the problem with the current tax code is that low- and middle-income households have it way too good, and they should give more of their income to those poor Americans making more than half a million dollars a year," Andrew Fieldhouse, a budget analyst for the liberal Economic Policy Institute, blogged recently.

Still, the 9-9-9 plan has at least two things that other tax plans lack: a catchy slogan worthy of the most popular pizza deal and a charismatic voice to promote it.

Cain is viewed as a long shot for the nomination because of his lack of political experience, connections and organization, and because of some early stumbles on foreign policy and Islam. But he has raised his profile by turning in a series of good-natured debate performances that highlighted his skill as an orator.

Cain also has won positive reviews from voters who appreciate his willingness to tackle wonky details by introducing 9-9-9.

Lately, support has been growing in conservative circles for the "fair tax," which would replace virtually every federal tax, including the income and corporate tax, with a national sales tax of 23 percent. Several GOP presidential candidates, including Rep. Michele Bachmann of Minnesota and Texas Gov. Rick Perry, have spoken approvingly of the proposal, and Cain considers 9-9-9 a stepping stone toward such a tax.

Liberals have criticized the "fair tax" as regressive.

The 1914 income tax maxed out at 6 percent only any income you made over $500,000.

Please note that Herman Cain's 9 percent income tax that applies to EVERYBODY is 50 percent higher then the 6 percent 1914 income tax on people that made a half a million or more.

And of course Herman Cain's 9 percent income tax on EVERYBODY is 9 times higher then the first U.S. income tax of one percent, which only applied to well off people in 1914 who made $3,000 or more, which is equivalent to people making $40,000 to $50,000 in 2011 dollars.

And of course in those days, and even now there wasn't a National Sale tax.